EXECUTIVE SUMMARY

PURPOSE OF THE STUDY

This study has been jointly commissioned by Cruise Lines International Association (CLIA) Australasia in collaboration with Australian Cruise Association (ACA). It represents an economic impact assessment of cruise tourism in Australia for the 2024-25 season (financial year).

ECONOMIC IMPACT OF CRUISE TOURISM IN AUSTRALIA 2023-34

The 2024-25 Economic Impact Assessment of Cruise Tourism in Australia highlights that while cruise continues to deliver strong national benefits, supporting thousands of Australian jobs and a robust supply chain that reaches communities nationwide, overall activity has softened from last year’s record high. This reflects the growing challenges Australia faces in maintaining its competitiveness against other global cruise regions.

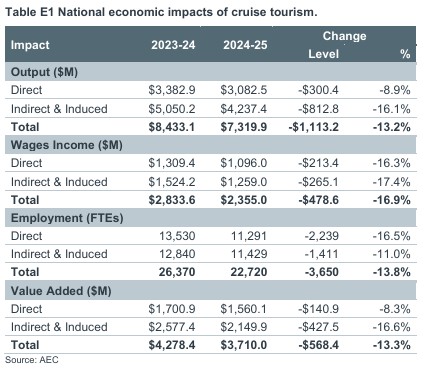

• The total economic output from cruise tourism in 2024-25 was estimated at $7.32 billion, down from $8.4 billion in 2023-24, representing a significant 13.2% decrease following last year’s record-high results.

• Direct wages income fell by 16.3%, from $1.3 billion to $1.1 billion, whilst overall supported employment fell by 13.8%, from 26,370 full-time equivalent (FTE) positions to 22,720 FTEs.

• The total value-added impact decreased from $4.3 billion to $3.7 billion, marking a 13.3% decline.

Despite these declines, cruise tourism remains a vital contributor to Australia’s visitor economy, delivering a total economic output of $7.32 billion and supporting more than 22,000 full-time equivalent jobs. The sector’s performance demonstrates the enduring strength of consumer demand for cruise holidays, and underscores its ongoing importance to communities and supply chains nationwide.

DECLINE IN CRUISE ACTIVITY

The decline in activity is not due to lack of passenger demand but reflects a reduction in ship deployments, turnaround visits, and capacity. This is driven by a less competitive operating environment, as higher costs, regulatory uncertainty and global competition have influenced deployment decisions for the 2024-25 season.

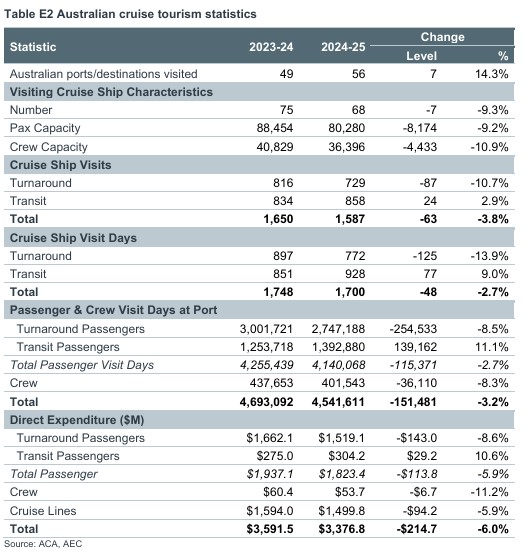

• The number of cruise ships operating in Australian waters decreased by 9.3%, from 75 ships in 2023-24 to 68 in 2024-25, with passenger capacity shrinking by 8,174 to 80,280.

• Total cruise ship visits fell by 3.8%, with a notable decrease (-87) in turnaround visits, which are particularly valuable due to their larger economic impact, but an increase (+24) in transit visits.

EXPENDITURE DECREASES

• Passenger expenditure decreased by 5.9%, from $1.9 billion to $1.8 billion, while crew expenditures fell by 11.2%, reflecting the lower number of passenger and crew visit days.

• Cruise line expenditures fell by 5.9%, from $1.6 billion to $1.5 billion, driven by the reduced activity.

These results reinforce that Australia cannot afford to be complacent. While the fundamentals of cruise demand remain strong, future growth will depend on ensuring Australia remains competitive through supportive national policy.

STATE-SPECIFIC IMPACTS

The economic impact of cruise tourism varied across Australian states, with New South Wales and Queensland leading in total output:

• New South Wales: Generated $3.9 billion in total output, a 10.7% decrease, supporting 12,408 jobs, driven by Sydney's role as the primary cruise port.

• Queensland: Recorded $2.04 billion in total output, down 15.7%, with significant contributions from Brisbane and Cairns.

• Victoria, South Australia, Western Australia, and Tasmania: All experienced slight declines in cruise activity and economic output, driven by decreased ship visits and passenger expenditures.

• Northern Territory was the only jurisdiction to record an increase in total output of 13.3% to $206 million. This was due to an increase in visits, turnaround calls and cruise line expenditure.

METHODOLOGICAL UPDATES

The 2024-25 report incorporates updated 2022-23 ABS input-output tables, which reflect changes in industry structure and productivity. Additionally, expanded data collection through new passenger and crew expenditure surveys, particularly in Northern Territory (Darwin), has improved the accuracy and reliability of the economic impact estimates.

TRENDS AND FUTURE PROSPECTS

The Australian cruise market continues to show resilience and sustained consumer appetite. Yet future growth will depend on maintaining competitiveness with other global regions. Rising operating costs, the absence of planning certainty and inconsistent regulatory frameworks have begun to influence deployment patterns.

Sustained growth will depend on policy alignment, improved certainty for cruise line planning cycles, and collaboration between governments, ports, and industry, aligned with global best practices.

CONCLUSION

The 2024-25 Economic Impact Assessment confirms that cruise tourism remains a vital pillar of Australia’s visitor economy, and continues to deliver significant value to Australia’s economy and to destinations across the nation. Yet, as CLIA and ACA have cautioned for several years, Australia cannot be complacent.

To secure Australia’s place as a leading cruise destination, governments and industry must work together to enhance competitiveness, streamline regulation, and provide the certainty needed for long-term deployment planning.

This is essential to attract ships, safeguard jobs, and sustain the wide-reaching economic benefits cruise delivers into the future. Without these changes, Australia risks losing further ground to other markets that are moving faster to attract new ships and investment.